From 0 to $10K ARR: Real Conversations, Real Lessons

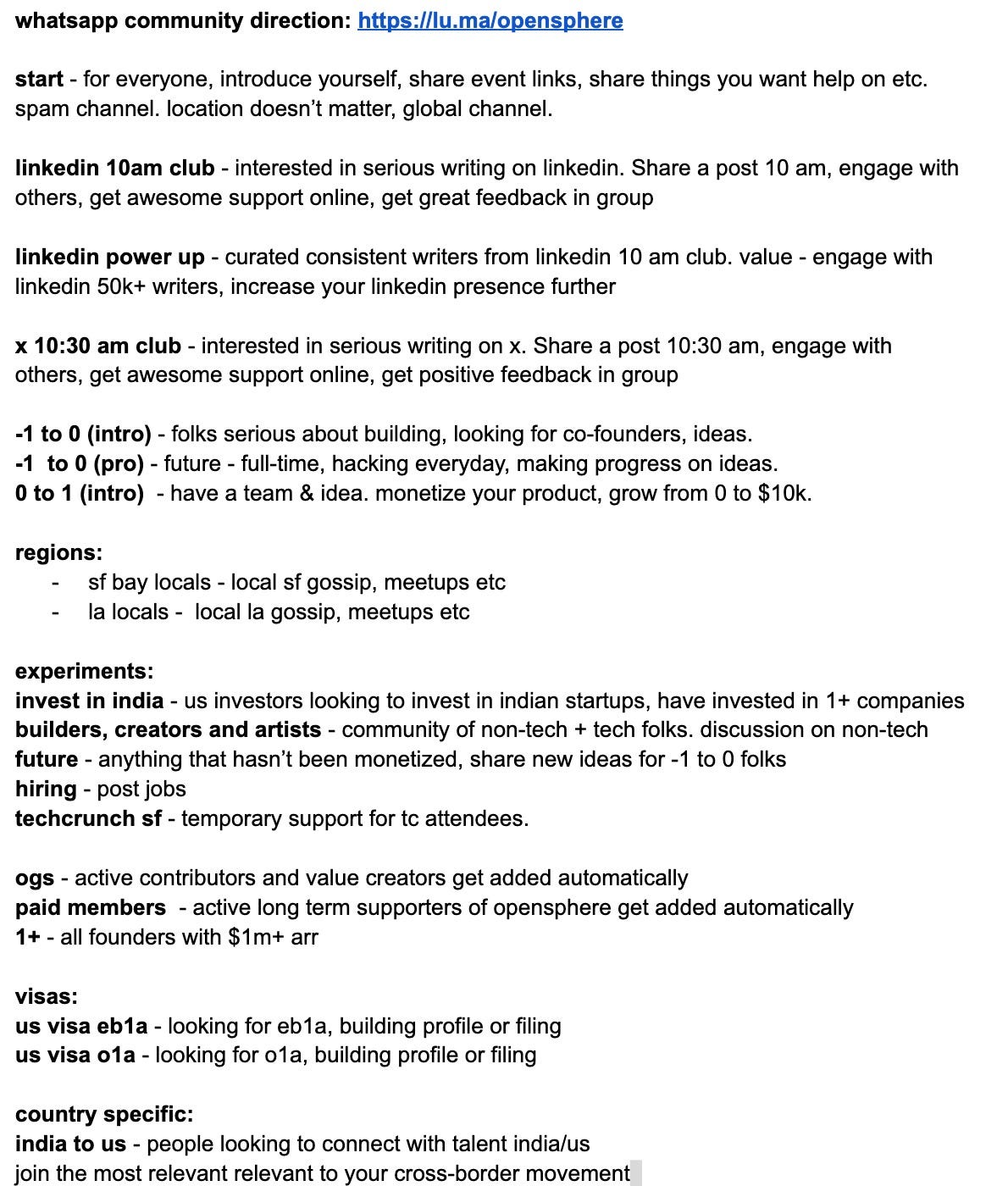

WhatsApp group chat.

Hello Founders and Builders,

We’re pulling back the curtain on OpenSphere’s “0 to $10K ARR” WhatsApp group—a high-impact, no-nonsense space where early-stage founders come together to discuss real-world questions and get immediate, actionable advice. This unfiltered Q&A captures the essence of our conversations. It’s filled with genuine insights that can guide you as you navigate the path to your first $10,000 in annual recurring revenue.

Every answer here comes from real discussions with founders facing the same challenges. Dive in, take notes, and apply these strategies to your own journey!

Pricing & Early Client Management

Q: How much should I charge early clients?

A: It’s about creating the right perception. Here’s a proven approach:

Start with a call, ask questions, and offer a demo.

If they’re interested, propose a $500 setup fee.

If they hesitate, ask, “How can I ensure you’ll give quality feedback?”

Aim for weekly calls and provide excellent customer service (respond to queries within 15 minutes).

After a month of trial (if they paid the $500), consider raising your rates.

Q: Should I avoid yearly contracts in the early days?

A: Yes, avoid lengthy contracts at the start. Focus on engagement and value—the more they use the platform, the stronger your revenue.

Q: I’m limited to sending 30 personalized cold emails a day. How can I scale my outreach?

A: Use tools like Apollo.io and LinkedIn to connect with leads. Build initial rapport by liking and commenting on their posts. When they’re familiar with you, it’ll be easier to pitch directly.

Q: How do I prevent my domain from being flagged as spam?

A: Use multiple domains (e.g., startup.com, startup.ai) for outreach to protect your primary domain’s reputation.

Q: Can you share the link for Apollo?

A: Sure! Here it is: Apollo.io (about $250/year). Another solid option is Instantly.ai.

Q: Any psychological tips for sales?

A: Sales is all about psychology. Avoid making clients feel sold to; frame your product as helpful, guiding them toward a solution rather than pushing a sale.

Q: How do I narrow down a broad customer base to find my ideal market?

A: Focus on creating a detailed Ideal Customer Profile (ICP):

Identify specifics like “single tech professionals in the Bay Area.”

Conduct at least 50 interviews with similar profiles to refine your ICP based on real insights.

Q: Can I target multiple industries with my AI chatbot, or should I focus on one?

A: Start with one niche. The AI chatbot market is crowded, so find a “blue ocean”—an untapped niche with less competition. Specificity will strengthen your positioning and scalability.

Q: Should I create a waitlist or give immediate access?

A: Avoid waitlists if possible. Immediate access lets users start engaging with your product, offering feedback to improve it quickly. We’ve learned that waitlists can lead to lost opportunities and delayed product development.

Q: Is there a “reputation risk” for letting people into an imperfect product?

A: Don’t let concerns over reputation hold you back. Most startups fail because they delay too long. Use early adopters to validate and refine your product.

Q: How do I minimize legal expenses in the early stages?

A: Keep legal processes simple. Use standard “boilerplate” agreements and take advantage of free credits (AWS, GCP) to reduce costs. Reserve equity; consider paying advisors with cash or business exchanges rather than shares.

Q: Can I get a simple boilerplate agreement for initial contracts?

A: Absolutely! Reach out, and I can help draft one. Legal agreements can be costly and complex, but they don’t have to be at the start.

Q: How can I monetize a community of 8,000 across multiple platforms?

A: Focus on indirect monetization. Partner with companies for affiliate promotions that align with your community’s needs, like visa assistance or business incorporation services.

Q: How do I keep community members engaged?

A: Weekly updates are effective. We have members share updates, top challenges, and wins every Monday. This helps with accountability, keeps people motivated, and fosters engagement.

Q: What’s the best way to structure equity and vesting for founders?

A: For founders, 8-10 year vesting schedules encourage long-term commitment. Avoid giving equity too quickly, especially with advisors, as it can dilute value. Instead, explore cash incentives or revenue shares.

Q: What’s the term for advisors working for credit instead of immediate pay?

A: It’s not exactly “pro bono”; some refer to it as “time debt.” Ensure terms are clearly defined from the start to avoid issues down the road.

Q: How can we keep each other accountable as founders?

A: Each Monday, we share weekly updates on achievements, challenges, and upcoming targets. This structure helps everyone stay on track and gives members a chance to learn from one another.

Ideal Update Schedule: Mondays are a great day for sharing updates after the weekend.

Competition Tracking: Some founders avoid watching competitors closely, focusing instead on meeting their customer’s needs.

Early Community Building: Engaging in public forums and sharing your journey helps build relationships that can pay off when you’re ready to launch.

Handling First 100 Customers: Personalized customer service during this phase can create lifelong advocates for your brand.

Our goal with this Q&A is to show you how real founders think, iterate, and build to reach that first $10K ARR. This isn’t just theory—these are hard-earned lessons that will give you a clear path forward.

Happy building!